Picture supply: Getty Photographs

Scottish Mortgage Funding Belief (LSE: SMT) presents UK inventory buyers one thing completely different from the remainder of the FTSE 100. The belief goals to put money into what it sees because the world’s most distinctive development corporations, no matter the place they’re situated geographically.

Listed below are 5 the reason why an investor would possibly think about loading up on Scottish Mortgage shares whereas they’re nonetheless underneath £10.

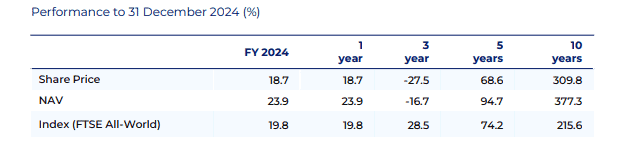

Stable monitor document

The primary is efficiency, which is what an actively managed fund is finally judged on. Has it outperformed the market over significant time intervals?

Within the case of Scottish Mortgage, it’s delivered the products. Over the ten years to the top of 2024, the online asset worth (NAV) had elevated by 377%, versus 216% for the benchmark (the FTSE All-World index).

The belief has held three tech shares for 10 years or extra. These are Amazon, Tesla, and chip-making tools big ASML. All have accomplished fantastically properly over this timeframe, although the belief has been promoting down Tesla in current months.

One other one price mentioning is Nvidia, which it first purchased in 2016. Because of the speedy rise of the chip maker, Scottish Mortgage has taken roughly £1.5bn of revenue from an preliminary £64m funding. And it nonetheless has a decent-sized place in Nvidia left over!

Personal investments

Second, roughly 1 / 4 of the portfolio is in unlisted belongings, which equates to 50 holdings. So the belief presents buyers publicity to thrilling development corporations not listed on the inventory market.

Whereas many are bite-sized, some holdings are very giant. In truth, of the world’s 10 most useful non-public corporations, Scottish Mortgage owns half of them (SpaceX, ByteDance, Stripe, Databricks, and Epic Video games).

With a 7.2% weighting in February, SpaceX is the most important holding within the portfolio. The house firm’s valuation has ballooned to $350bn as a result of its dominance within the rocket launch market and fast-growing satellite tv for pc web enterprise (Starlink).

A few of these corporations might go public at very excessive valuations within the subsequent couple of years, boosting Scottish Mortgage’s NAV within the course of.

Low charges

The third purpose to think about investing is the price construction. In keeping with the most recent factsheet, the continuing cost is simply 0.35%. That’s low for a worldwide fairness fund that additionally presents publicity to unlisted corporations like SpaceX. Many cost 0.75%–1%+.

Over time, decrease charges can compound into considerably higher internet returns.

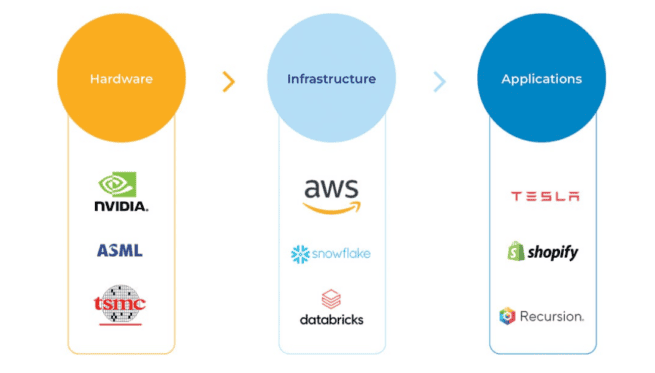

Deep AI publicity

Subsequent, the belief presents a simple and diversified technique to put money into the continuing synthetic intelligence (AI) revolution.

Up to now 12 months, the belief’s managers have been shopping for or including to shares that they assume are completely positioned to profit from the know-how. These embody Taiwan Semiconductor Manufacturing (TSMC), which is the main producer of AI chips, Shopify, and social media big Meta Platforms.

This excessive publicity to AI is one threat I see right here although. If the know-how fails to ship the effectivity positive factors anticipated, then buyers would possibly turn into disillusioned with AI. On this state of affairs, the worth of the belief might fall sharply.

10% low cost

Lastly, the shares are buying and selling at a ten% low cost to NAV. Whereas there’s no assure this hole will slim (it might even widen), it presents long-term buyers an opportunity to think about shopping for under honest worth.