Listed below are the three Finest Cryptocurrency shares to purchase in July 2024, in accordance with Wall Avenue analysts. Bitcoin (BTC-USD) costs have been on a roll this 12 months, gaining over 48.7% year-to-date. The bitcoin halving occasion in mid-April this 12 months decreased the block reward for mining bitcoins by half.

It’s vital to spotlight that bitcoin costs rallied over $64,000 on July 15, following the information of the tried assassination of former President Donald Trump. This was additionally accompanied by the share price surges of a majority of Bitcoin miners.

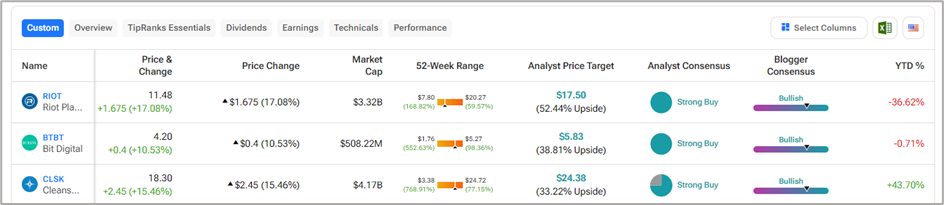

Traders searching for publicity to the dynamic crypto-mining trade typically discover it tough to cherry-pick shares. We leveraged the TipRanks Inventory Comparability device for Cryptocurrency Shares to find three miners with a “Strong Buy” consensus ranking and over 30% share price appreciation potential within the subsequent twelve months. Let’s be taught extra about why the three miners have earned analysts’ bullish views.

#1 Riot Platforms (RIOT)

Riot Platforms is among the largest Bitcoin miners on the earth. Riot additionally hosts information facilities for miners and manufactures electrical elements and immersion-cooling expertise for Bitcoin mining.

Riot has been within the information these days for its deliberate hostile acquisition of fellow Canadian miner Bitfarms (BITF). As of date, Riot owns 14.9% of Bitfarms’ frequent inventory and has nominated three new members to the latter’s board. In the meantime, Bitfarms resorted to the Poison Capsule technique to avert the takeover.

In its June buying and selling replace, Riot Platforms exceeded its Q2 focused hash charge capability, by reaching 22 EH/s (exahash per second). This was attainable as Riot’s Corsicana mining facility began operations in June.

Moreover, Riot produced 255 bitcoins in June, up 19% sequentially however down 45% year-over-year. As of June 30, Riot held 9,334 bitcoins in its treasury.

Riot is on observe to attain a complete self-mining hash charge capability of 31 EH/s by year-end 2024 and 41 EH/s by the top of 2025, by deploying extra miners on the Rockdale facility and energizing full capability at its Corsicana facility.

Is RIOT Nonetheless a Purchase?

Eight analysts have given their unanimous Purchase views on RIOT inventory, resulting in a Robust Purchase consensus ranking on TipRanks. Wall Avenue is optimistic about Riot’s rising hash charge capability, low-cost mining operations, and stable steadiness sheet. Additionally, the typical Riot Platforms price goal of $17.50 implies 52.4% upside potential from present ranges. In the meantime, year-to-date, RIOT shares have misplaced 25.8%.

#2 Bit Digital (BTBT)

Bit Digital is a digital asset miner with mining operations within the U.S., Canada, and Iceland. Bit Digital makes use of carbon-free power options for mining digital property. Furthermore, Bit Digital operates Bit Digital AI, providing specialised cloud infrastructure options for AI (synthetic intelligence) purposes.

In June, BTBT produced 61.7 BTC, down 2.5% from Might 2024. On the finish of the month, the corporate’s energetic hash charge was 2.57 EH/s. BTBT held 585.9 BTC and 29,927.9 Ethereum (ETH-USD) as of June 30, 2024.

Not too long ago, the corporate expanded an current buyer contract so as to add 2,048 GPUs over a three-year time period. The deal is anticipated so as to add extra income of $92 million on an annual foundation for the following three years.

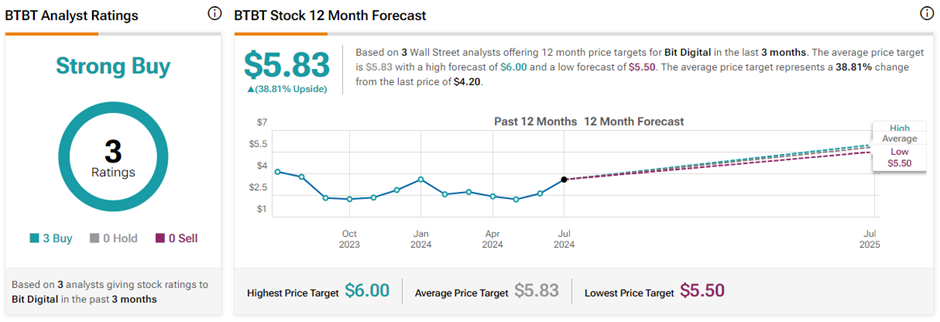

Is Bit Digital a Good Funding?

Three analysts have awarded a unanimous Robust Purchase consensus ranking for BTBT inventory on TipRanks. The typical Bit Digital price goal of $5.83 implies a 38.8% upside potential from present ranges. Previously six months, BTBT shares have gained over 51%.

#3 CleanSpark (CLSK)

CleanSpark is a sustainable Bitcoin mining firm that makes use of renewable power options corresponding to nuclear, hydroelectric, photo voltaic, and wind to energy its mining operations. The corporate operates information facilities that run on low-carbon energy and a number of mining services in Georgia, New York, and Mississippi.

As of June 30, CLSK had a hash charge of 20.4 EH/s, exceeding its half-year goal of 20 EH/s, and rising 13.5% in comparison with Might 2024. Additionally, CLSK mined 445 bitcoins in June and ended the month with 6,591 BTC in its treasury.

Remarkably, CleanSpark additionally introduced a deal to amass GRIID Infrastructure (GRDI) in an all-stock deal price $155 million. The acquisition will considerably enhance CLSK’s mining operations and hash charge capability.

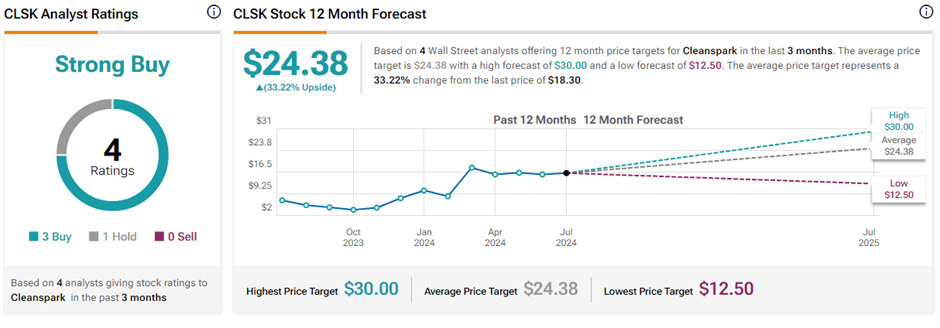

Is CleanSpark a Good Inventory to Purchase?

With three Buys and one Maintain ranking, CLSK inventory instructions a Robust Purchase consensus ranking on TipRanks. The typical CleanSpark price goal of $24.38 implies 33.2% upside potential from present ranges. Within the meantime, CLSK shares have zoomed over 65.9% to this point this 12 months.

Ending Ideas

Investing in cryptocurrency miners carries a excessive risk-reward profile. Even so, buyers seeking to achieve publicity to the quickly evolving digital asset market would possibly take into account the aforementioned three cryptocurrency shares to reinforce their portfolio. These firms have obtained sturdy bullish scores from analysts and present stable potential for share price appreciation.

Disclosure