Picture supply: Getty Photos

Searching for methods to create life-changing wealth? Right here’s three techniques I’d use to try to maximise my returns with UK shares.

Slash tax prices

Step one I’d take it to set up a tax-efficient funding automobile. There are at present two in the marketplace that shield people from each capital beneficial properties tax (CGT) and dividend tax.

The primary is the Particular person Financial savings Account (ISA). Below this class, buyers should buy shares, trusts, and funds in a Lifetime ISA and/or a Shares and Shares ISA.

The opposite possibility I’ve is to open a Self-Invested Private Pension (SIPP).

Over a number of a long time, these merchandise can save people actually tens of hundreds of kilos in tax. It’s one purpose why the variety of Shares and Shares ISA buyers has soared 27% previously 10 years, to three.8m at the moment.

Please word that tax remedy is dependent upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Diversify my holdings

With this set up, I’ll be seeking to create a diversified portfolio that gives a powerful and secure return yr over yr.

It will contain shopping for a mixture of worth, development, and dividend shares spanning a number of sectors and geographies. Such a method would assist me to handle threat in addition to seize quite a lot of development alternatives.

I don’t essentially have to purchase a lot of shares to attain diversification, nonetheless. I may select to purchase a fund or a belief that invests in a large number of various property.

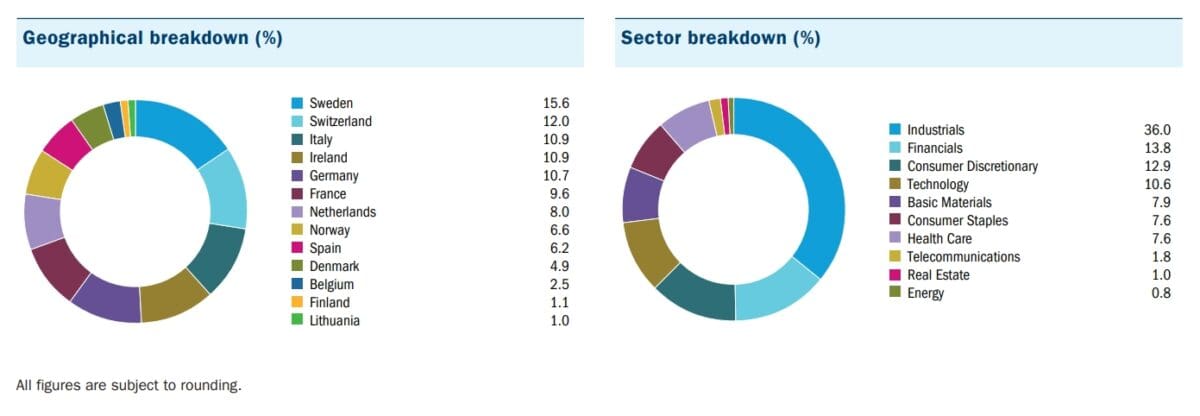

The European Belongings Belief (LSE:EAT) is one such monetary instrument. It’s been going since 1972, and invests in small and mid-sized corporations throughout many various nations and industries.

On the draw back, the belief’s deal with smaller corporations might end in disappointing returns throughout financial downturns. This has been the case extra not too long ago as main European economies have stalled.

However with inflation fading, now could possibly be a great time to open a place. Because the belief feedback: “Europe’s hugely dynamic smaller companies have generated some of the strongest returns among global stock markets over the past 15 years.”

I additionally suppose the belief presents glorious worth at present costs. At 83.4p per share, it trades at a 13% low cost to its internet asset worth (NAV) per share.

Traders may seize a wholesome 6.7% dividend yield at at the moment’s costs.

Reinvest any dividends

The ultimate step on my quest to create long-term wealth can be to reinvest any dividends I obtain. This manner, I can reap the benefits of compounding, the place reinvested dividends generate extra earnings over time.

Primarily, this implies I earn cash on the curiosity (or dividends) I obtain in addition to on my preliminary funding. The extra shares I purchase, the extra dividends I obtain. Over time, this snowball impact could cause my portfolio to swell significantly.

Let’s say I make investments £10,000 in a 5%-yielding dividend inventory. In yr one, I make £500 in dividends, which I exploit to purchase extra shares. This offers me a portfolio price £10,500, which on the finish of the second yr will give me an improved £525 in dividends (primarily based on that 5% yield).

After 10 years of rising my portfolio like this, I’d be receiving round £814 in annual dividends, assuming the inventory price and dividend yield stay secure. And my whole investments might be price £16,289 versus simply £10k.