Picture supply: Getty Photos

The FTSE 100 is dwelling to an enormous array of high-quality dividend shares.

The UK’s main share index might lack the razamatazz of the tech-led S&P 500. Nevertheless, its massive weighting of ‘boring’ shares — people who function in conventional, mature industries relatively than high-growth sectors — makes income and money flows far much less risky.

This good mix is vital for traders in search of a powerful, sustained, and rising passive earnings over time.

However dividends are by no means, ever assured. So whats the very best tactic for somebody with a £20,000 lump sum to speculate at this time?

Focusing on stability

An more and more standard choice is to contemplate a FTSE 100-tracking exchange-traded fund (ETF), which may present each capital features and dividend earnings.

By holding your complete index, an ETF will help traders considerably scale back threat. If one or two firms expertise bother, the general affect on an earnings stream could be smoothed out.

That mentioned, there are a number of necessary caveats with this method.

Nevertheless…

Firstly, the price traders pay for this safety is a fairly low yield.

At 3.5%, the FTSE 100’s ahead dividend yield is decrease than the present rate of interest on most Money ISAs. Somebody who invested £20k in a Footsie ETF at this time would (if forecasts are appropriate) make a middling £700 passive earnings this yr.

Secondly, whereas funds like this scale back threat the chance of poor dividend earnings, they don’t get rid of it totally. This was obvious in 2020, when scores of blue-chip shares minimize, cancelled or postponed dividends when the pandemic hit.

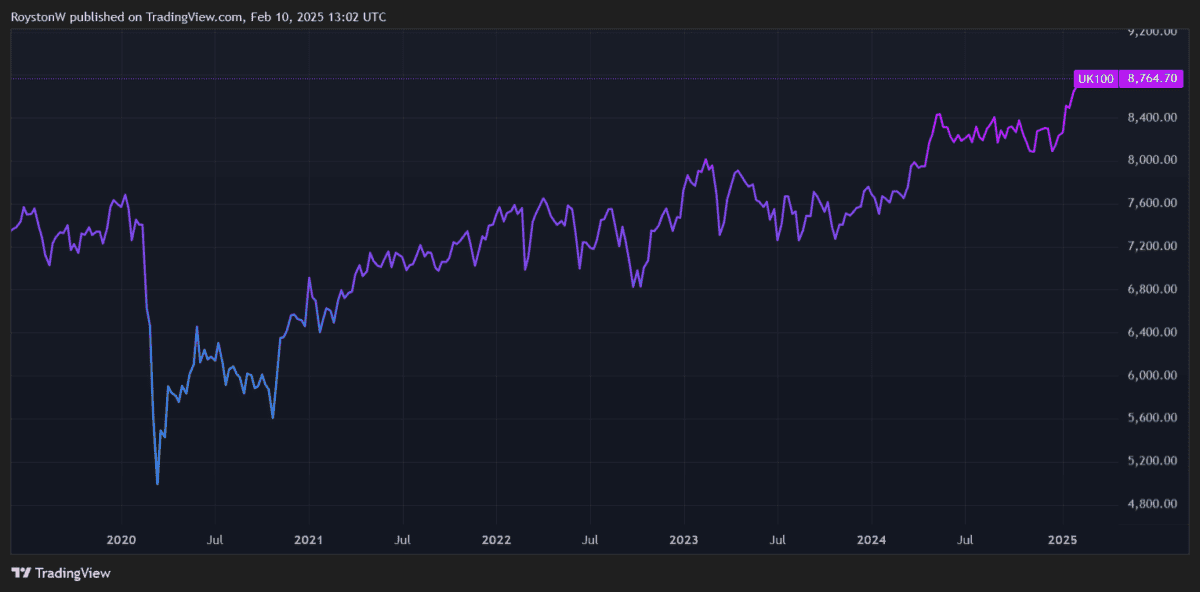

Lastly, poor share price progress means the general returns on FTSE-tracking ETFs have been disappointing lately. Since 2015, the index has delivered a mean annual return of 6.5%.

A big dividend earnings is very enticing. Nevertheless, weak share price efficiency can erode passive earnings advantages over the lengthy haul.

A £2,040 passive earnings

For that reason, buying particular person shares could be a greater method for traders to focus on passive earnings.

There’s no proper and mistaken reply within the ETF vs stock-picking argument. This depends upon anybody’s threat tolerance and monetary targets, together with one’s stage of investing expertise.

Nevertheless, these in search of a big passive earnings at this time and market-beating returns also needs to contemplate shopping for particular shares as a part of a diversified portfolio.

Let’s take Authorized & Common (LSE:LGEN) for example. Contemplating a £20k funding right here at this time would — if dealer forecasts show appropriate — present a £2,040 passive earnings in 2025. That’s based mostly on a ten.2% ahead dividend yield.

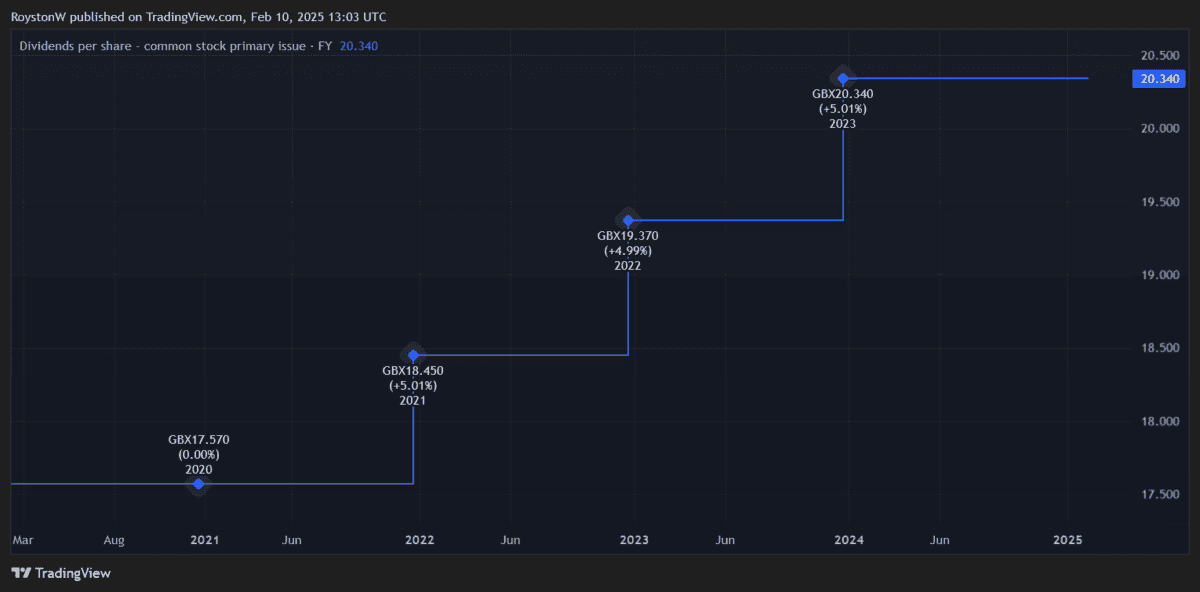

On high of this, traders can realistically count on dividends on Authorized & Common shares to maintain rising over the short-to-medium time period no less than. The enterprise, which has raised annual payouts in 12 of the final 13 years, is money wealthy and had a Solvency II ratio of 223% as of June, greater than double regulatory necessities.

Since 2015, Authorized & Common shares have supplied a mean annual return of 4%. That’s 2.5% beneath the return an FTSE 100 ETF might have delivered.

However I’m optimistic that general returns, together with dividends, will beat the Footsie common trying forward. Regardless of aggressive pressures, I believe income might soar as monetary providers demand — and particularly gross sales of retirement and wealth merchandise –quickly grows.