Picture supply: Getty Photographs

I’m trying to find the most well liked UK shares, funds, and trusts for ISA buyers to think about for the New 12 months. This entails on the lookout for low-cost shares which have potential to soar if the market recognises their mis-valuations.

With this in thoughts, listed here are two undervalued FTSE 100 and FTSE 250 shares I believe might rocket in worth. However that’s not all. I’m additionally a surging exchange-traded fund (ETF) I consider could have additional to go in 2025.

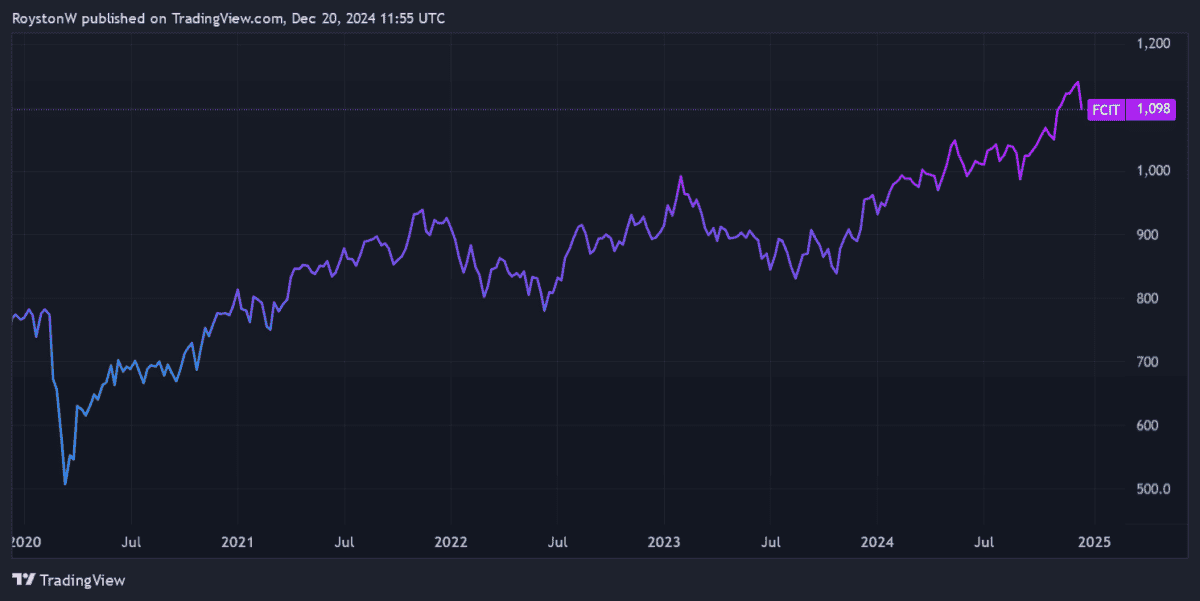

F&C Funding Belief

The F&C Funding Belief (LSE:FCIT) has put in an index-beating efficiency in 2024. So far, it’s up round 15%, far forward of the Footsie’s 4% rise.

But it nonetheless seems low-cost on paper. At £10.90 per share, it’s buying and selling 6.5% under its internet asset worth (NAV) per share.

For me, the belief provides an ideal mix of high quality and variety. It counts top-drawer names like Nvidia, Microsoft, Apple, Mastercard, and Eli Lilly amongst its 10 largest holdings. However with stakes in additional than 400 world companies, it additionally helps buyers to successfully unfold threat.

There’s a hazard that F&C’s fund might endure some turbulence subsequent 12 months, nevertheless. The cyclical shares it holds could drop if, as an example, inflationary pressures persist or new commerce tariffs are launched.

That mentioned, I believe its low valuation nonetheless makes it price a really shut look.

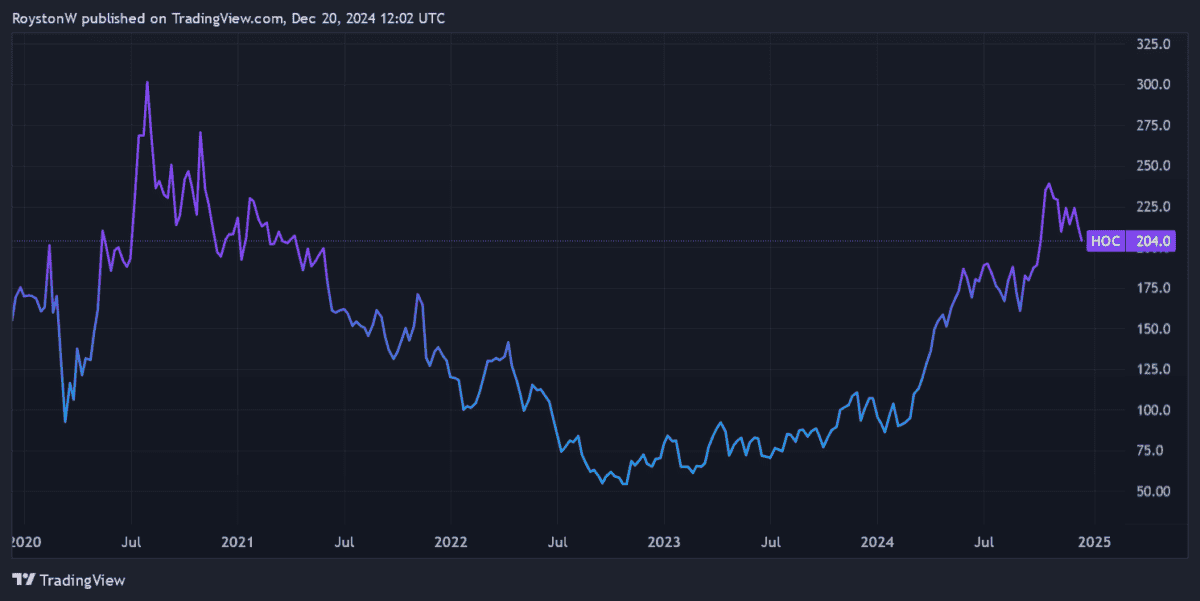

Hochschild Mining

Valuable metals miner Hochschild Mining (LSE:HOC) has doubled in worth over the course of 2024. Nevertheless, at present costs of 204p per share, it additionally seems like an undervalued gem to me.

The FTSE 250 agency’s price-to-earnings (P/E) ratio is a rock-bottom 5.6 instances. In the meantime, its price-to-earnings development (PEG) ratio, at 0.1, is effectively under the worth watermark of 1.

Hochschild shares have soared because of huge rises in gold and silver values. And subsequent 12 months could possibly be one other huge 12 months for safe-haven metals given ongoing macroeconomic uncertainty and geopolitical tensions.

Metropolis analysts suppose so. It’s why they’re predicting Hochschild’s earnings to soar 58% 12 months on 12 months.

Robust manufacturing at its Brazilian property offers the agency good momentum going into 2025. However keep in mind that operational points are a continuing menace to even one of the best mining shares.

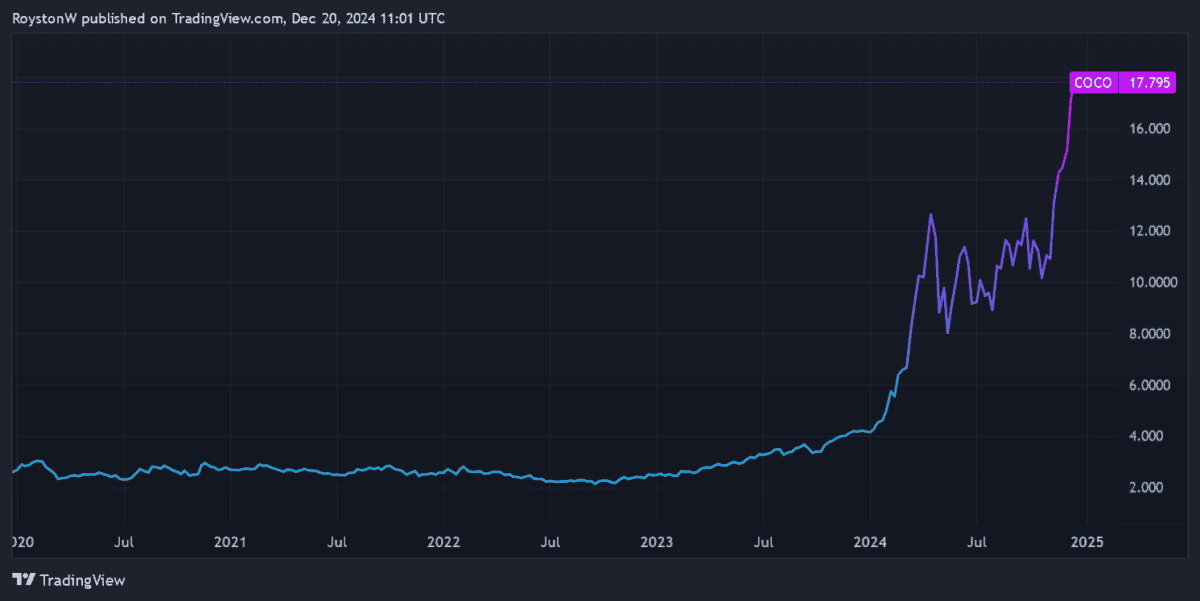

WisdomTree Cocoa

2024 has been a spectacular 12 months for cocoa costs. The chocolate ingredient’s soared 170% within the 12 months thus far, pushed by hedge funds exiting futures markets and poor climate circumstances in key producing areas.

With provide points lingering, I believe WisdomTree Cocoa (LSE:COCO) — an ETF which mimics the Bloomberg Commodity Cocoa Subindex 4W Complete Return Index — might take pleasure in one other blowout 12 months in 2025.

Poor harvests in West Africa have pushed world cocoa shares to multi-year lows. Latest climate points threaten additional crop points in 2025 that might maintain the market in a price-boosting deficit.

As with all commodity, buyers must be ready for potential price volatility forward. However as local weather change causes extra frequent excessive climate occasions, I believe the WisdomTree Cocoa fund might ship wonderful long-term returns.