Picture supply: Getty Photographs

The US election passed off on 5 November 2024, and, as everyone knows, was gained by Elon Musk ally Donald Trump. £10,000 invested in Tesla (NASDAQ:TSLA) inventory two weeks earlier than Trump’s election would now be value £12,723, representing a major 27% improve in worth over the previous 5 months. The pound is just about flat in opposition to the greenback over the interval, so there’s no must think about trade charge fluctuations.

What’s been happening?

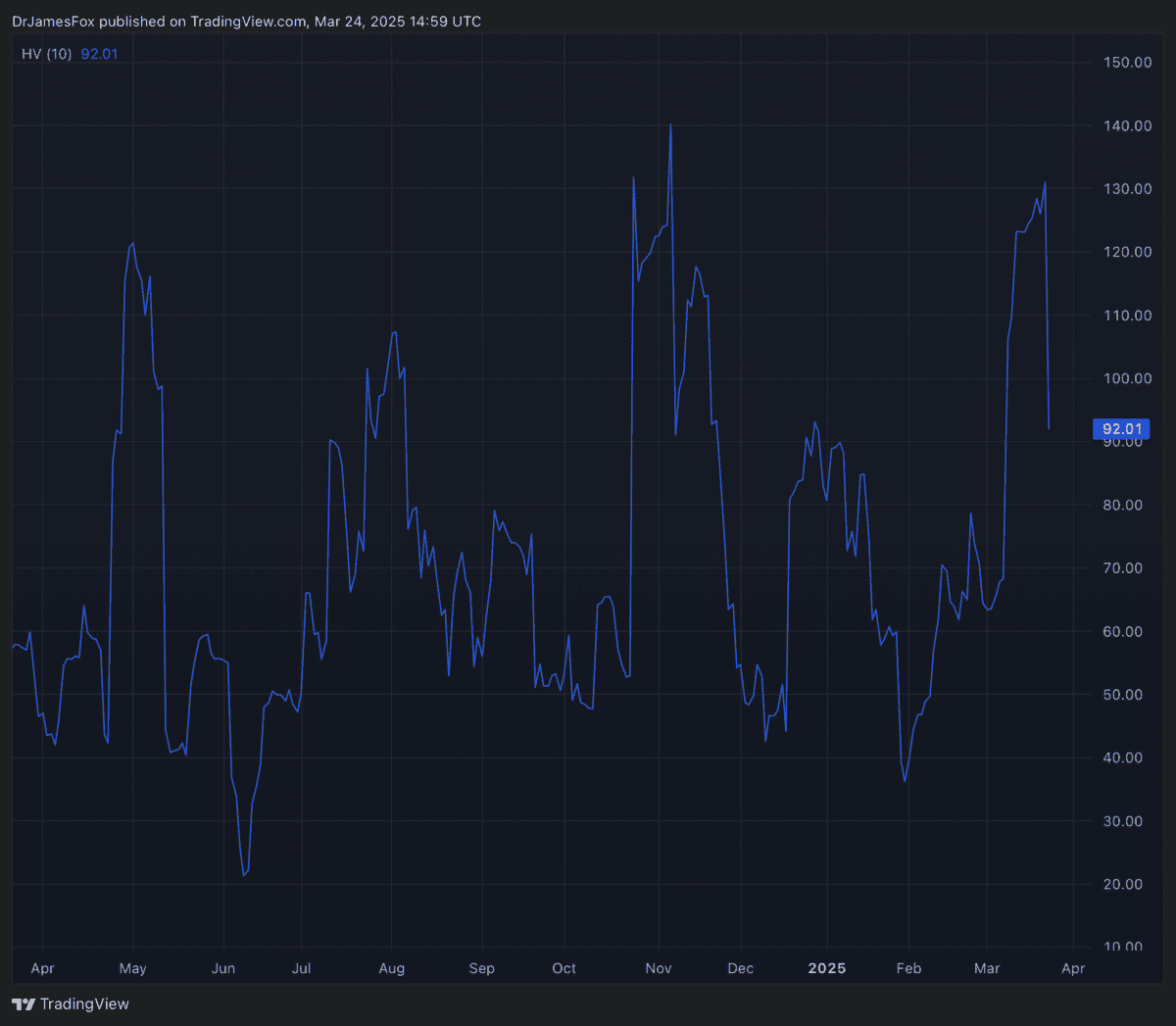

Regardless of the features over the interval, it’s been a roller-coaster experience for shareholders. Initially, the inventory jumped following Donald Trump’s victory within the US presidential election. Tesla CEO, Musk, had publicly supported Trump’s marketing campaign and was seemingly able to play an essential function within the administration — we now know that function is with DOGE (the Division of Authorities Effectivity).

Tesla’s share price rocketed 38% in November 2024, however that was simply the beginning. The inventory peaked in December, simply 2% beneath $500 a share. This partially mirrored the idea that with Musk a part of the administration, he would be capable of safe regulatory approval for his autonomous driving undertaking — that is important to Tesla’s worth proposition. What’s extra, there was some perception that Trump’s coverage would help the US automotive manufacturing business.

The collapse

Nevertheless, the euphoria was short-lived. Because the starting of 2025, Tesla’s inventory has crashed. To begin with, Trump’s tariffs have endangered Musk’s provide chain, with China, Canada, and Mexico first within the firing line. The administration has additionally turn out to be largely unpopular abroad as a result of its onerous bargaining/some might say blackmail.

Illustrating this, Danish pension funds, AkademikerPension, has formally blacklisted Tesla and offered off all its shares within the automaker. Whereas the fund particularly highlighted points with Musk, it’s value noting that Trump has demanded the nation hand over Greenland to the US.

But it surely hasn’t all been Trump’s fault. Musk has seen his public approval ranking plummet in current months with the often-eccentric billionaire firing enormous numbers of federal employees. What I name the ‘Tesla salute’ didn’t go down all that nicely, both. Gross sales figures have additionally disenchanted.

The place subsequent?

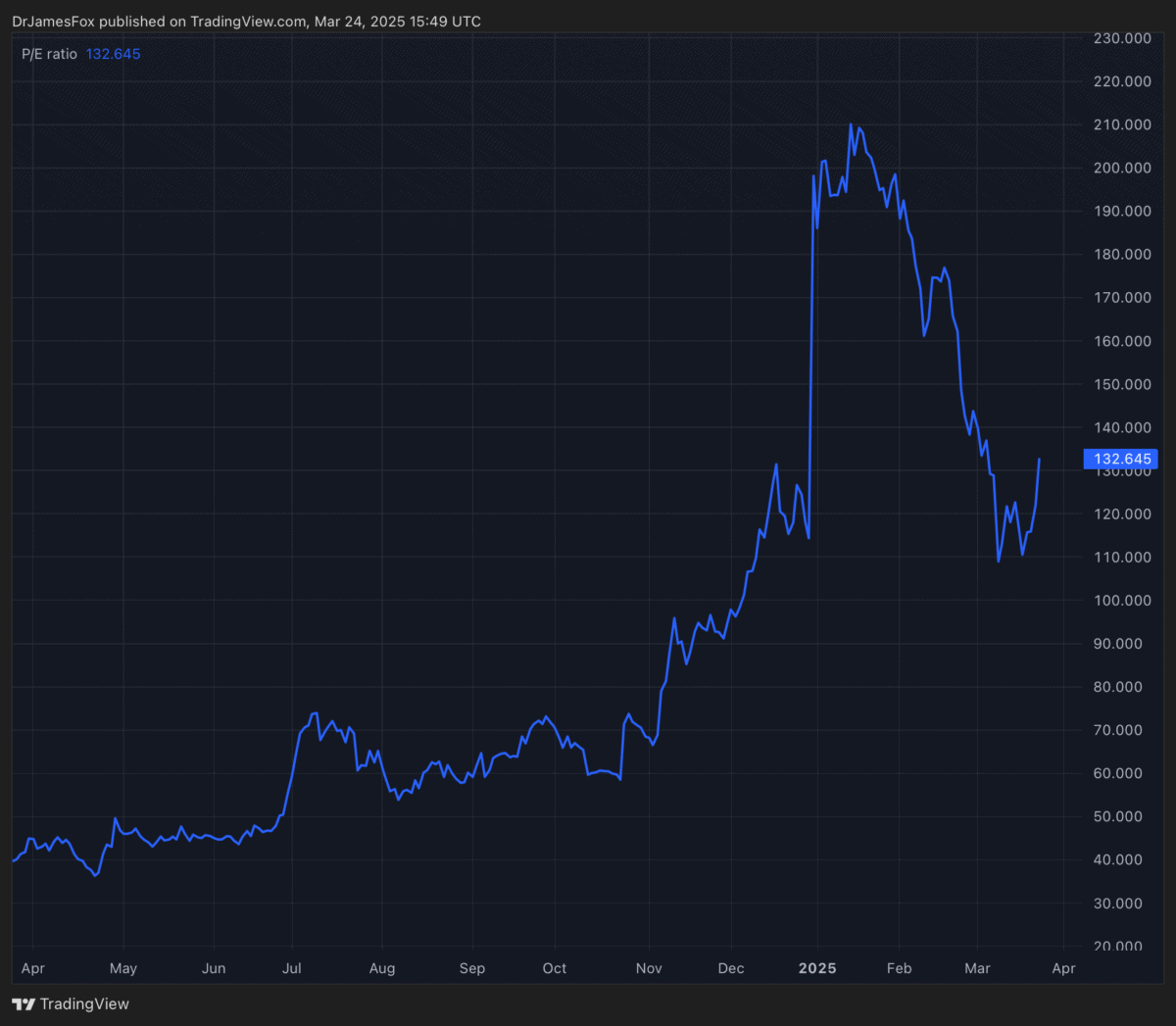

Regardless of the current downturn, it’s essential to know that Tesla’s valuation just isn’t based mostly solely on its present monetary efficiency. The corporate’s price-to-earnings (P/E) ratio has been notoriously excessive. Tesla inventory at present trades at 94 occasions ahead earnings.

The P/E-to-growth (PEG) ratio, which elements in an organization’s anticipated earnings progress, can be exceptionally excessive at 5.7. This means that traders are pricing in substantial future progress, which analysts are but to quantify, notably in Tesla’s autonomous driving and robotics divisions.

As such, Tesla’s valuation is basically based mostly on its potential within the autonomous car market and its developments in synthetic intelligence (AI) and robotics. Nevertheless, for now not less than, it does appear to be falling behind its friends. Solely time will inform whether or not Tesla actually does have technological dominance right here.

Personally, I’d relatively Tesla succeeded than its Chinese language friends. Nevertheless, I’m struggling to place my cash behind the inventory on the present valuation. I don’t count on to speculate anytime quickly.