Picture supply: Getty Photographs

Barclays (LSE:BARC) shares are up 80% over two years. It’s an exceptional turnaround with a lot of the development coming up to now 12 months. As such, a £10,000 funding then could be price round £19,200 immediately. That’s after we embrace dividends. Two years in the past, the dividend yield was shut to six%.

Explaining the expansion

Barclays’ 80% share price surge over two years displays a confluence of things. These embrace its strategic plan and reallocation of risk-weighted property (RWAs) in February 2024. Whereas the financial institution’s plan to shift £30bn of RWAs from its funding banking division to higher-returning shopper and company banking segments has been a key driver, broader enhancements in market sentiment and macroeconomic circumstances have additionally performed a big position. Rising rates of interest have bolstered internet curiosity margins, contributing to a 6% rise in whole revenue to £26.8bn in 2024.

Moreover, the FTSE 100 firm’s acquisition of Tesco Financial institution has enhanced Barclays’ retail banking operations, whereas cost-cutting initiatives have diminished the fee/revenue ratio to 62%. The financial institution’s dedication to shareholder returns, together with a £1bn share buyback programme and a 5% dividend hike, has additional supported investor confidence.

Bettering sentiment across the UK banking sector, pushed by easing recession fears and stabilising inflation, has additionally underpinned the rally. Nonetheless, dangers stay, together with potential financial challenges and execution challenges within the RWA rebalancing technique. In spite of everything, consumer-focused banks are sometimes reflective of the well being of the economic system, and the UK continues to be misfiring. Barclays’ skill to maintain this momentum will depend upon its continued supply of strategic and monetary targets.

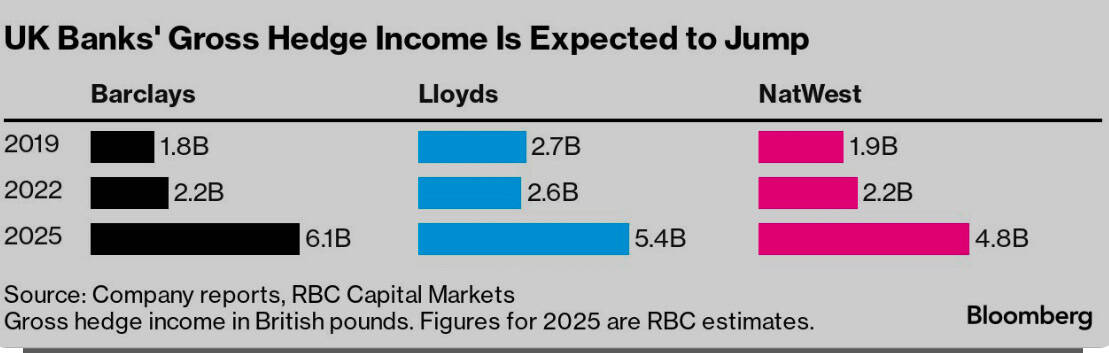

Hedging is central to the present thesis

Whereas the share price is significantly elevated versus two years in the past, there’s good motive for it. The UK emerged from a interval of very excessive inflation in doubtlessly the absolute best approach, and we’re now experiencing a sluggish unwinding of financial coverage.

Barclays actively manages rate of interest fluctuations by a mix of product and structural hedges. The product hedge includes fixed-rate merchandise like mortgages and time period deposits, the place rate of interest threat is mitigated by swapping fastened money flows to floating charges utilizing rate of interest swaps.

The structural hedge, then again, targets rate-insensitive merchandise like present accounts and instantaneous entry financial savings accounts, that are behaviourally steady however uncovered to fee fluctuations. Barclays swaps these to floating charges, making certain revenue stability and safety in opposition to sharp declines in rates of interest.

The structural hedge’s common period is round 2.5 years, balancing revenue safety with responsiveness to fee adjustments. In periods of falling charges, such because the 2008-2009 monetary disaster, this hedge technique restricted revenue declines to lower than 5%, in comparison with a possible 90% drop with out hedging.

Wanting ahead, this hedging ought to ship important profit and infrequently unappreciated revenue because the Financial institution of England cuts charges. What’s extra, the latest pullback has seen the price-to-earnings ratio fall to a comparatively enticing seven instances. It’s one of many the reason why I’m contemplating including to my Barclays place.