Picture supply: Getty Photographs

Robust market situations imply that Authorized & Normal (LSE:LGEN) shares have delivered an underwhelming return since April 2015.

At 249.8p per share, the FTSE 100 firm has dropped 5.7% in worth over the previous decade from 265.10p. It signifies that £10,000 price of shares bought a decade in the past is now price £9,430.

This isn’t the type of efficiency long-term holders of Authorized & Normal shares would have been hoping for. Nonetheless, a gentle circulate of blue-chip-beating dividends means the general return isn’t as poor because the inventory price alone suggests.

Since late April 2015, the monetary providers big has paid dividends totalling 167.17p a share. As a consequence, somebody who invested £10k again then would have made a complete return of £12,860, or 28.6%.

That’s far under the FTSE 100 common of round 84.2%. Nonetheless, may Authorized & Normal shares present index-beating returns going ahead? And may traders think about shopping for the corporate at the moment?

Costs to rise?

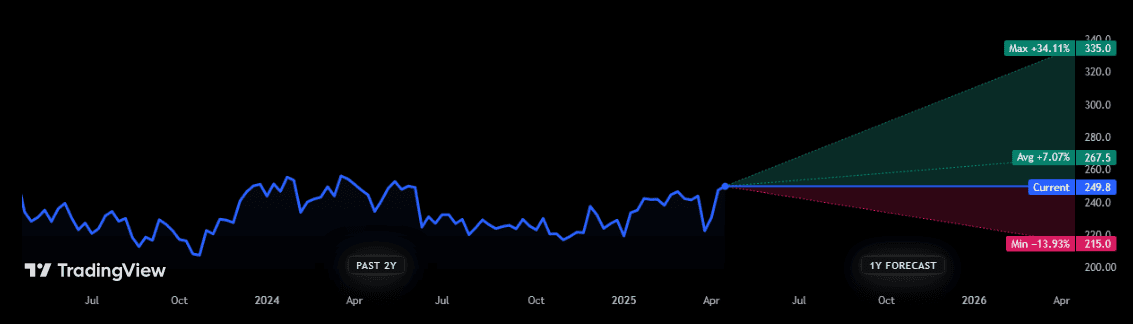

Sadly, Metropolis analysts don’t present price forecasts for the following 10 years. Nonetheless, estimates can be found for the following 12 months, and so they present room for optimism.

The 15 analysts with rankings on Authorized & Normal shares imagine they’ll admire by mid-single-digit percentages over the following 12 months. Nonetheless, analysts aren’t united of their evaluation, because the chart above reveals.

But with brokers additionally tipping extra market-beating dividends, I feel there’s likelihood of a strong return within the short-to-medium time period. Dividend yields sit above 9% for every of the following three years.

Between 2025 and 2027, Authorized & Normal plans to return round 40% of its market capitalisation (£5bn) to shareholders by means of a mixture of dividends and share buybacks. With a powerful stability sheet — its Solvency II capital ratio completed 2024 at 232% — the corporate appears in nice form to hit this goal too.

Ought to traders purchase Authorized & Normal shares?

That mentioned, I’m extra assured in Authorized & Normal’s dividend prospects than its share price. By specialising in discretionary monetary merchandise (suppose asset administration, life insurance coverage, and retirement merchandise), it’s at risk of stagnating and even falling as the worldwide financial struggles for traction.

The introduction of ‘Trump Tariffs’ and reciprocal motion from the US’ buying and selling companions threatens to choke off progress. It additionally means inflationary pressures may rise, placing additional strain on shopper spending.

However as a long-term investor, I imagine Authorized & Normal is a good share to contemplate (I maintain it in my very own portfolio). I imagine earnings will rise strongly over the following decade and past, pushed by fast inhabitants ageing throughout its markets and the rising significance of monetary planning. This might turbocharge demand for the providers it specialises in.

Within the meantime, traders can console themselves with these 9%-yielding dividends, even when Authorized & Normal’s share price underperforms. On stability, I feel the corporate may show one of many FTSE 100’s standout buys over the long run.