Picture supply: Getty Photos

In search of the most effective development shares to think about within the coming days? Right here’s one in all my favourites.

Development at an excellent price

Gold costs have hit recent highs every month up to now in 2025. I believe there’s an excellent likelihood of recent peaks in Might, making gold producers engaging shares to probably purchase.

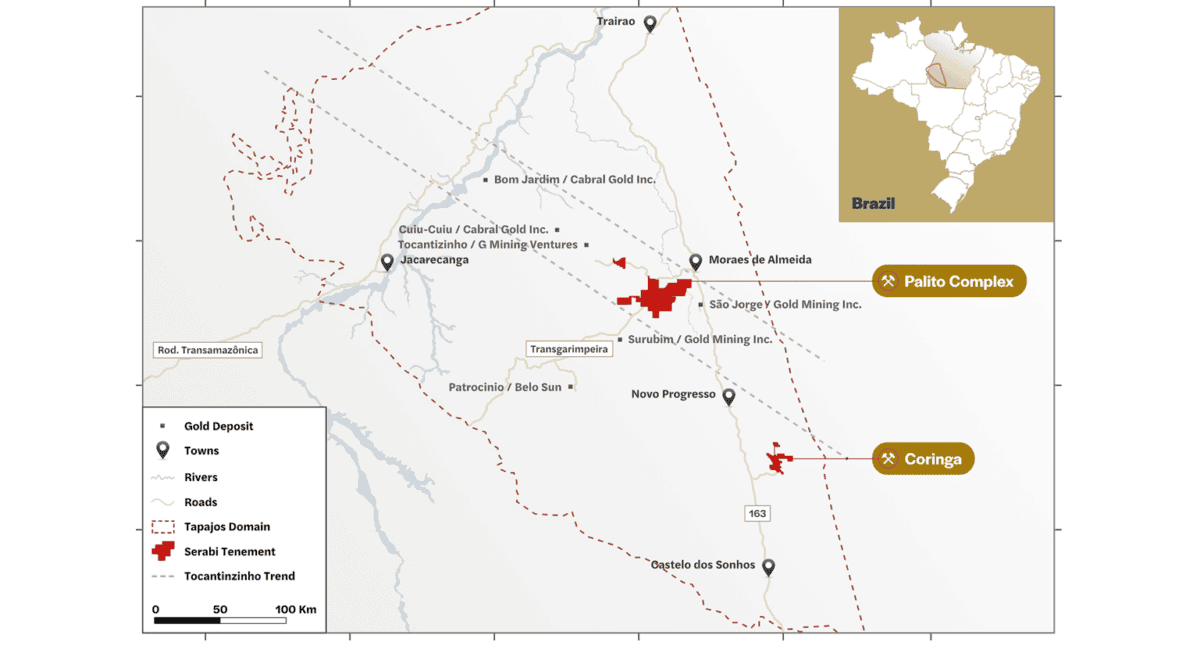

Of the a number of UK gold shares to select from, Serabi Gold‘s (LSE:SRB) one in all my favorite due to its gorgeous worth. Metropolis analysts count on earnings to soar 88% in 2025, pushed by lofty gold costs and steps to extend output. This leaves the Brazilian miner buying and selling on a price-to-earnings (P/E) ratio of three.2 occasions.

This additionally means Serabi shares commerce on a price-to-earnings development (PEG) ratio under 0.1. A reminder that any sub-1 studying signifies a share is undervalued relative to anticipated earnings.

Bull run

The sensitivity of gold shares’ earnings to metallic costs could be a blessing or a curse. So whereas Serabi’s price is hovering in the meanwhile, it’s essential to keep in mind that a downswing in bullion values might pull it again to earth with a bang.

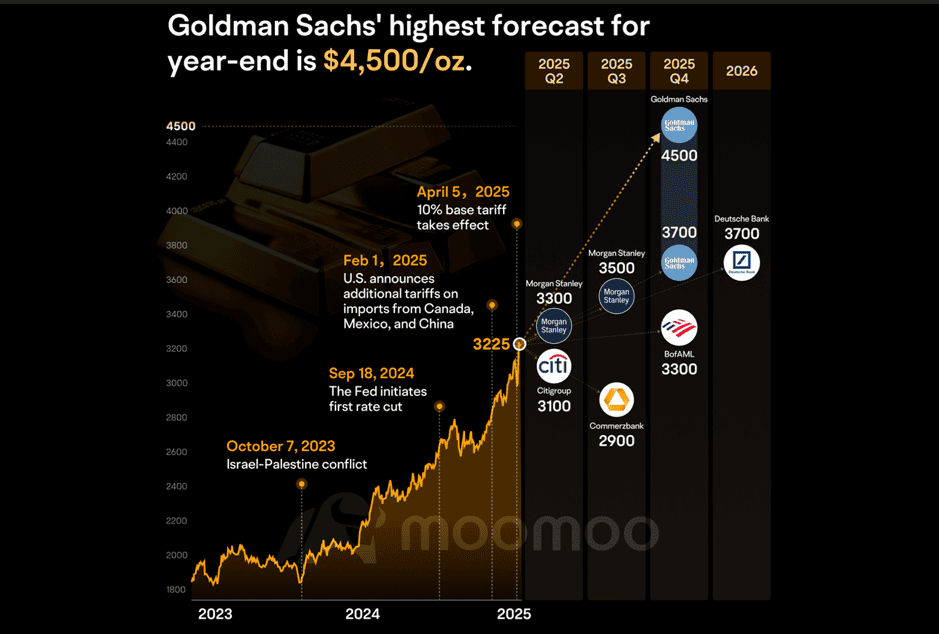

That mentioned, I’m optimistic that gold can proceed ploughing new territory within the weeks and months forward. My optimism is shared by a number of main banks too, a flavour of that are proven within the graph above.

Escalating commerce wars, international rate of interest cuts, a plunging US greenback, and rising geopolitical uncertainty all stay potential drivers for the yellow metallic, which is two-and-a-half years into its present bull run. Deliberate manufacturing ramp-ups might depart Serabi nicely positioned to capitalise on this too, if output ramps up to anticipated ranges.

Manufacturing development

Chief govt Michael Hodgson this month advised podcast Firm Interviews that enterprise plans is heading in the right direction to supply round 45,000 ounces in 2025, up from 37,520 ounces final 12 months.

As Serabi develops its Coringa asset and works to broaden its useful resource base, Hodgson mentioned he expects group output to move nonetheless larger. Over the subsequent few years, group manufacturing is tipped to hit:

- 60,000 ounces in 2026

- 70,000-75,000 ounces in 2027

- As much as 100,000 ounces by 2028

It’s essential to recollect nevertheless, that metals mining is a fancy and unpredictable enterprise. Even corporations with stable monitor data like Serabi can endure setbacks on the improvement and manufacturing phases that depress earnings and by extension the share price.

A gold-plated discount?

Moreover, miners who function in single territories like this are extra uncovered to each political and trade price dangers than producers that function in a number of areas. In the intervening time, Brazil is a beneficial place for Serabi to do enterprise on each fronts, although issues can change.

Nonetheless, it’s my perception that these dangers are mirrored on this particular miner’s rock-bottom valuation. As a leveraged technique to capitalise on the hovering gold price, I believe it’s a extremely engaging development inventory to think about right now.